Presidential Election Affect Mortgage Rates

Last election in 2016 rates were in the lower threes.

Presidential election affect mortgage rates. If so will rates rise or fall. Presidents politicians and policies undoubtedly have an impact on the economy. The presidential election presidents don t set mortgage rates.

The tax foundation estimates that by 2021 if biden s tax plan were enacted the top 1 of taxpayers would see their after tax income reduce by. The path from mortgage rates to the white house is a circuitous one. Let s go back to 2016 for a moment to the last presidential election.

But it is the federal reserve and financial institutions that ultimately set interest rates. Matthew garcia a senior loan officer with supreme lending says historically interest rates waver before an upcoming presidential election. There s not enough of a change using historical data to suggest that the presidential election has a significant impact on mortgage rates in either direction.

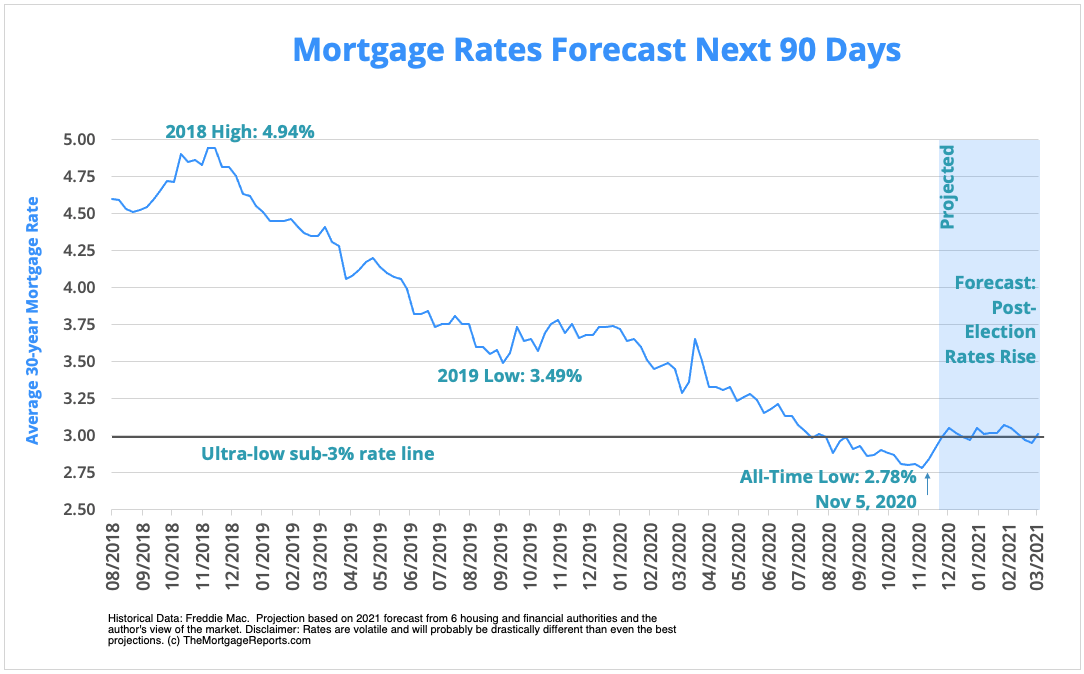

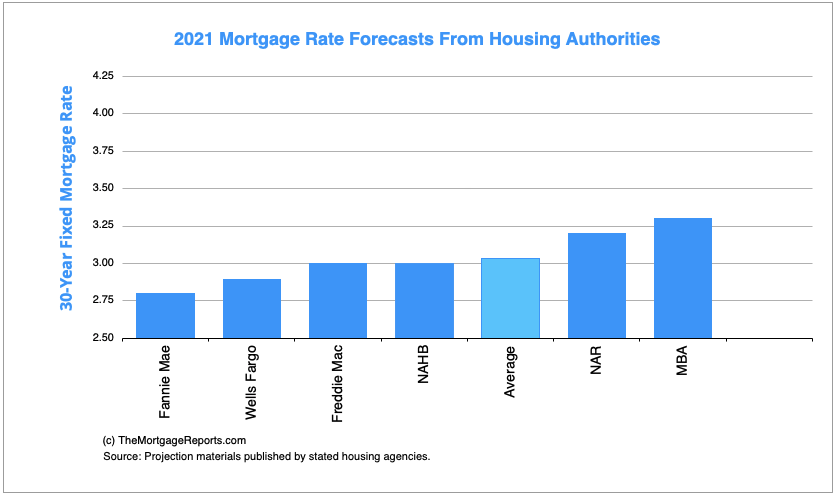

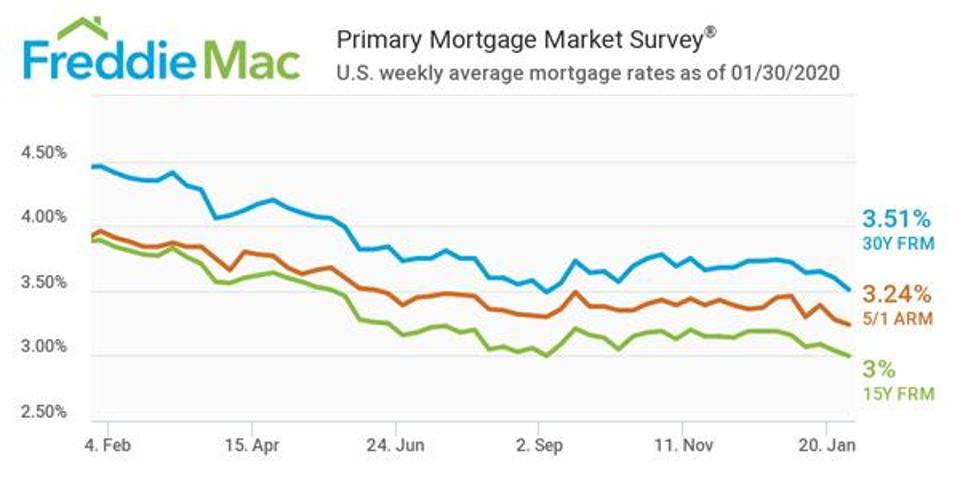

Even in light of an unclear 2020 presidential election mortgage rates hold steady at all time lows. According to freddie mac average mortgage rates went from 3 47 in october to 4 2 in december. Their tax rates would edge up to 39 6 from 37.

The 30 year fixed averaged 6 46 the week before the election and. In the recent election cycles when there is an incumbent president seeking a second term 2012 2004 and 1996 the mortgage rates have not swung as much. But could rates be affected by a probable biden administration.

The hartford funds recently fielded a survey on the 2020 presidential election and its impact on investing decisions and the financial professional client relationship which found that leading up. There is no direct route as the president doesn t control rates but there are factors the president controls in tandem with. If you were a home buyer.