Election Affect Mortgage Rates

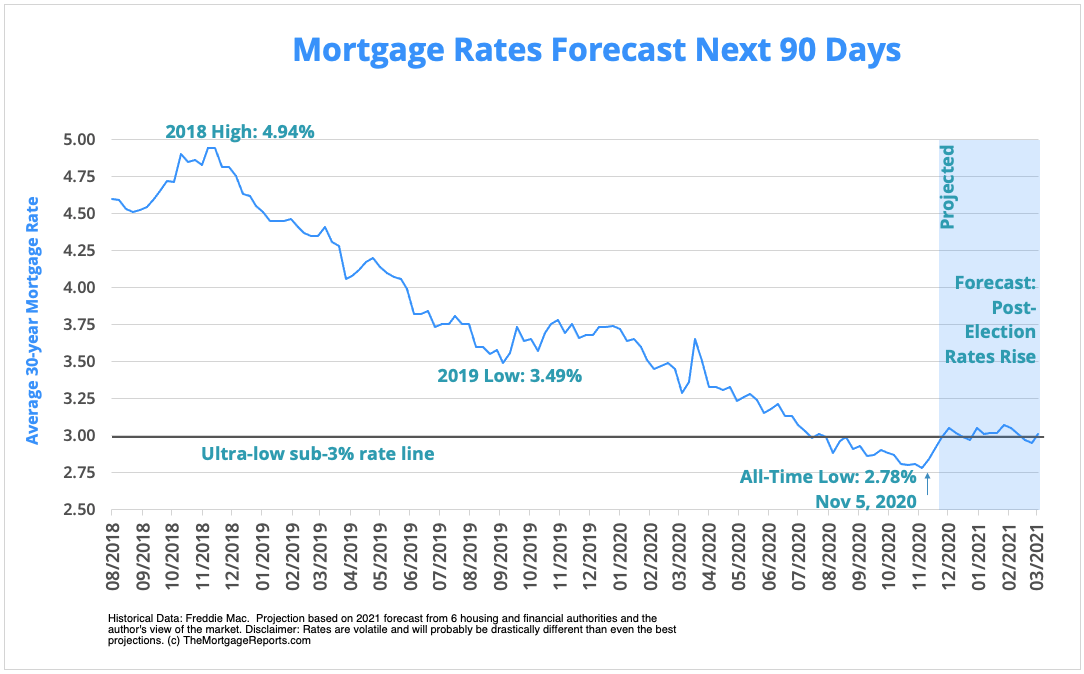

The 30 year fixed rate mortgage is at 2 81 according to freddie mac s latest primary mortgage market survey.

Election affect mortgage rates. In 1992 the average rate was 8 39. But experts say the upcoming election could have a major impact on whether. During the next four years it continued to fall.

Here s a list of the change in mortgage rates from november to december of recent election years. Other major factors like inflation rates and the price of us treasuries which have been in the news of late will dictate the housing market s interest rates nationally. In 2004 george w.

However the 2020 election winners can substantially impact mortgage rates depending on what actions they take. As we near the nov. Mortgage rates and presidential elections to determine if mortgage rates have been impacted by presidential elections 30 year fixed rate mortgages were compared in election years for november to december from 1972 to 2016 using the primary mortgage market survey from freddie mac which was first recorded in 1971.

Bankrate analyzed the 12 presidential elections since 1972 and found that mortgage rates increased six times and fell six times. The predictions today say that 2021 mortgage rates will be around 3. Clinton s reelection in 1996 interest rates declined by 0 21.

The fed doesn t set mortgage rates. For most of the pandemic people have enjoyed record low interest rates making way for a boom in mortgage refinancing. Bush won a second term and interest rates ticked up 0 03.

When looking at the effects of an election on mortgage rates it s important to realize. By the next election year 1988 the average interest rate on a 30 year mortgage was 10 34. High rates are good for savers and lower rates are good for borrowers.