83 B Election Form Where To File

Mail the completed form to the irs within 30 days of your award date.

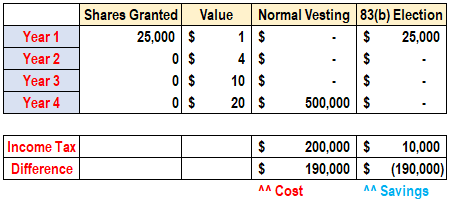

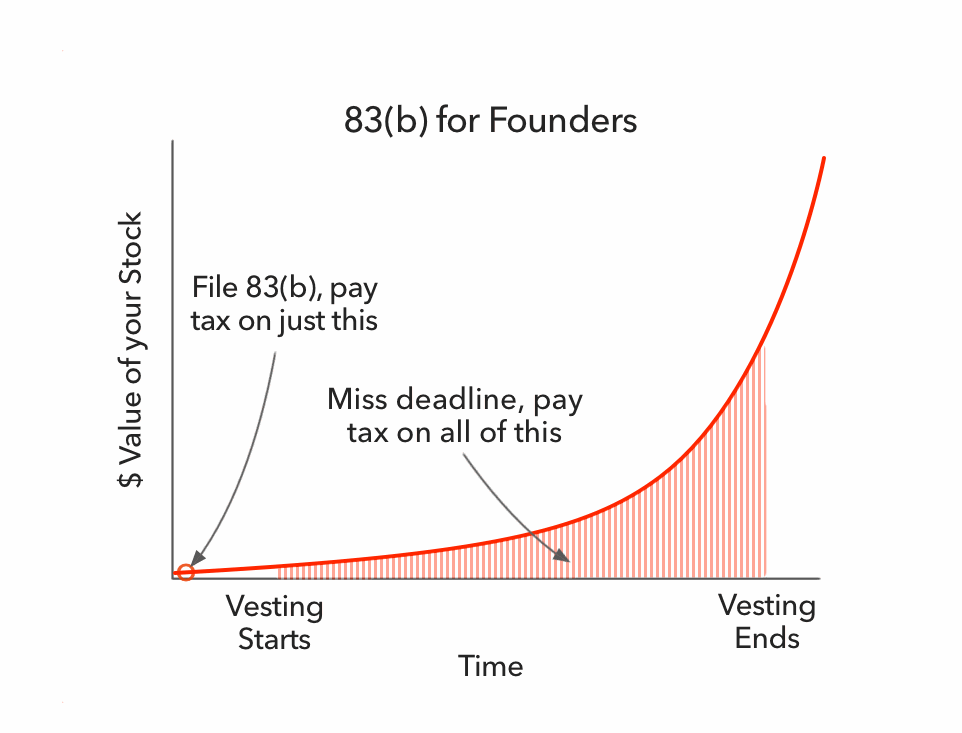

83 b election form where to file. If your stock is not subject to vesting then you can ignore this process and move on with your day. File at address listed in the forms or instructions. In summary a section 83 b election is a letter a taxpayer sends to the internal revenue service irs letting the irs know you would like to be taxed on your shares of restricted stock on the date you were granted equity rather than on the date the equity vests.

Now the issuing company will have access to a copy of the executed document. Within the 83 b election tab of the exercised option grant a scanned copy of the form can be uploaded for the issuing company. It is strongly recommended to submit a copy of your signed 83 b election form to the issuing company.

30 days to file 83 b we explained the reasons to file an 83 b election with the internal revenue service irs as a reminder the irs will void any election application sent after 30 days from the date the stock was granted. 83 b elections are not required for those without a vesting schedule. In our blog post vesting stock.

Steps to file your 83 b election. Download the sample 83 b election form and letter below. In addition to notifying the irs of the election the recipient of the equity must also.

Mail the letter and 83 b election form to the irs address see dropdown below for address within 30 days after the stock grant there is no relief if you file late. To make an 83 b election you must complete the following steps within 30 days of your award date. Sending the election via certified mail requesting a return receipt with the certified mail number written on the cover letter is also recommended.

The 83 b election documents must be sent to the irs within 30 days after the issuing of restricted shares. If an 83 b election is made the taxpayer recognizes income on the property in the year of the transfer rather than in a potentially later year when the property becomes vested. The filing is officially deemed to have been made on the date the 83 b is mailed from the post office.

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)