Gold Price Prediction After Election

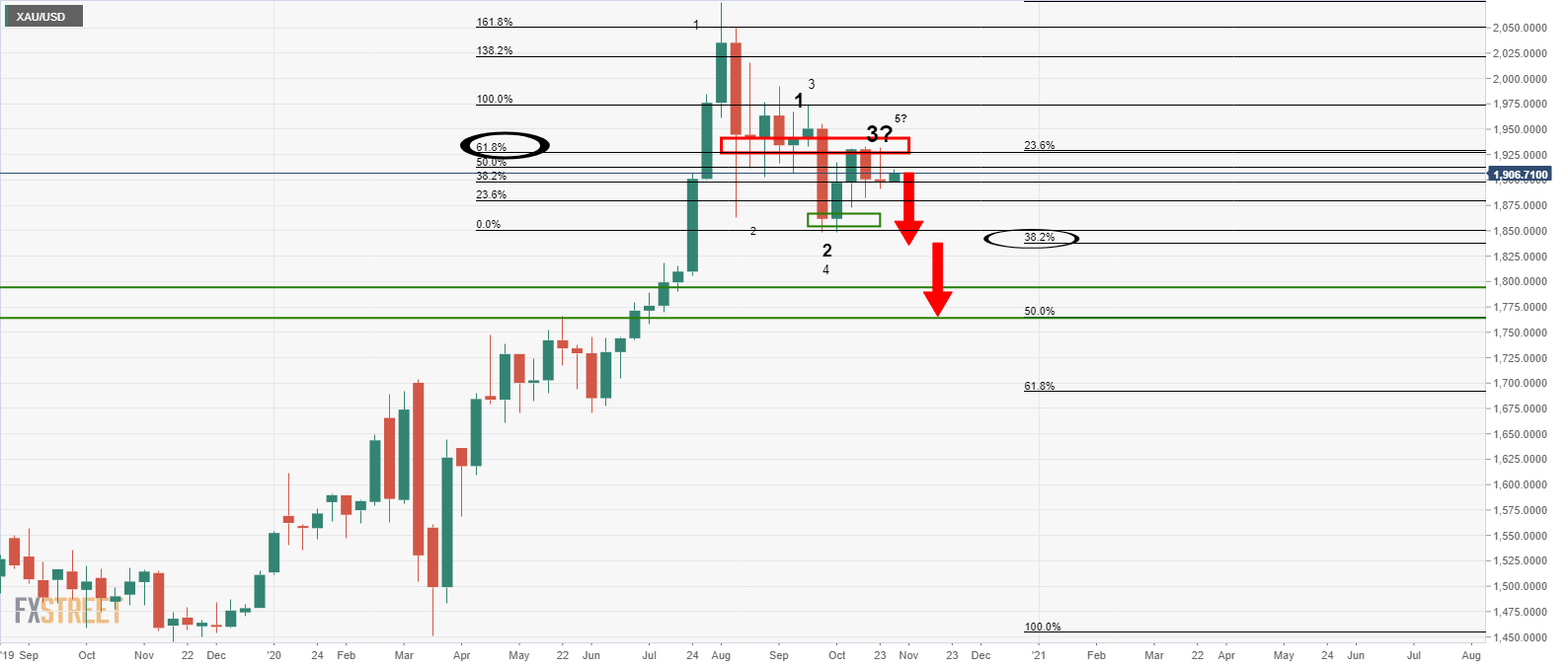

Gold prices have continued to grind lower since peaking on august 7 2075 14 as the absence of a much needed fiscal aid package the federal reserve s wait and see approach to monetary policy.

Gold price prediction after election. Presidential elections certainly play a big role not only in shaping the future of the world s largest economy at least for the next four years but the global economy in general. Citi believes the price could hit 1 700 oz. Gold prices dipped on thursday as the dollar steadied and comments from u s.

It turns out that on average the thick red line is the average based on the elections nothing really happened. A high dollar value means a lower price for gold while a weaker dollar means a higher price for gold. The effect of the election on the price of gold is a topic of passionate debate.

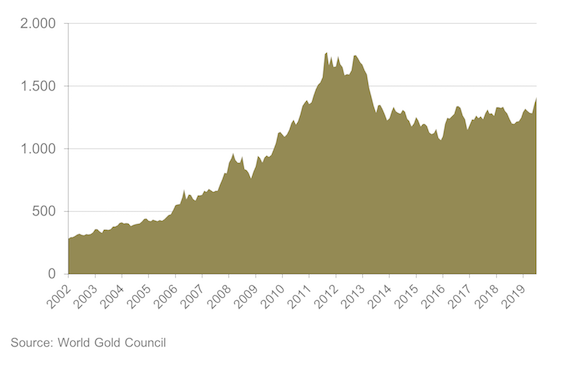

But citi analysts did say gold could cross the 2 000 mark within 12 to 24 months. At the same time the price of gold has been incrementally increasing since november 2016 it s risen from us 1 183 per ounce at that time to around us 1 900 a month before this year s election. Presidential elections in 2016.

Treasury secretary steve mnuchin dashed hopes of a new fiscal stimulus package before the presidential election. However if we look at the individual price paths it is evident that gold reversed its course on election day in 2008 and 2004. Presidential elections just a few weeks away the metals research team at refinitiv analyze how the gold price might react in the run up to the election day and the possible outcome.

The election could be an extraordinary catalyst for gold flat price and volatility skew late in the fourth quarter even though historically there is no clear pattern for gold trading or price. That could happen by election night he says.

_090519072611.jpg)