Election Form Capital Gains

This means 50 of the gains are taxed instead of 100.

Election form capital gains. This means 100 of the gain is taxed and 100 of a loss is deductible. For most taxpayers their gains and losses from the sale of securities are treated as capital gains and losses. For most capital property such as stocks bonds and portfolio investments the election mechanism effects a deemed disposition of the property at an amount between the property s cost base and its fair market value fmv.

Over the past year i have had to prepare several tax returns that involved the disposition of property that was owned prior to 1994. 1994 capital gains election. A capital loss can only be used to reduce or eliminate capital gains.

Prior to that date there was a 100 000 capital gains exemption that. See general information for details. Way back in 1994 the government eliminated the general lifetime 100 000 capital gains exemption on most capital assets.

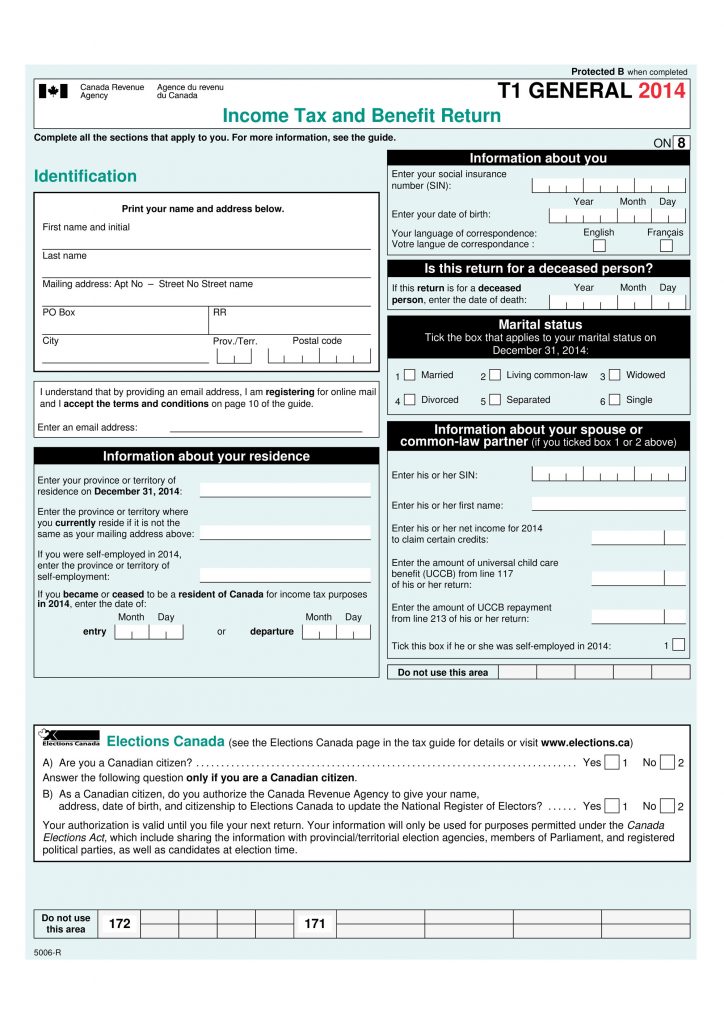

In most cases this election is available only for the 1994 taxation year. This form is for superannuation funds and their members to make a capital gains tax cgt cap election nat 71161. If you remember back 15 years that was the year that revenue canada cra eliminated the general capital gains exemption on most types of assets.

The election is an option that will allow you to report a capital gain on your income tax return to take advantage of the unused portion of your 100 000 capital gains exemption even though you did not actually sell your property. Capital gains tax cap election instructions and form. For some taxpayers such as day traders the gains and losses are determined to be business income not capital.

Form t664 was a tax form used to make an election to report a capital gain on property owned at the end of february 22 1994. You should complete this form if you make a personal super contribution using the capital proceeds of the sale of certain small business assets and you elect to exclude them from your non concessional contributions cap. There was however a one time election made on form t664 that allowed you to bump up the tax cost of the property by a maximum of 100 000.

/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)