Check The Box Election Regulations

To avoid being double taxed and ensure that foreign tax credits can be appropriately applied it may be advisable to make a check the box election.

Check the box election regulations. In treasury decision 8697 published in the federal register for december 18 1996 the internal revenue service adopted its so called check the box regulations setting forth its simplification of the entity classification rules. The check the box regulations treasury decision 8697 were adopted in 1996 in order to simplify the issue of entity classification. 1 an association taxed as a corporation 2 a partnership 3 a disregarded entity or 4 a trust.

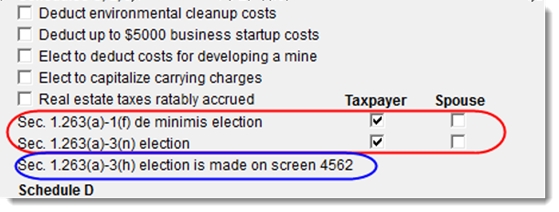

An election is necessary only when an eligible entity chooses to be classified initially other than under the default rule or when the entity chooses to change its classification. You simply check the appropriate box specify the date that the election is to be effective sign and file the form. This election essentially means that foreign corporations are choosing to elect their us tax status at the point in time that the us tax system becomes relevant to them.

In short a check the box election is an entity classification election that is made on i r s. A grandfather clause allowed entities in existence on may 8 1996 to continue using their previous classification even if they would no longer be eligible to elect that classification under the new rules. Form 8832 entity classification election.

Under those rules an eligible entity with just one owner may elect to be classified as a corporation or as an entity disregarded as separate from its owner disregarded entity. How do these new rules work. In december 1996 the internal revenue service issued final regulations often referred to as the check the box regulations that allow unincorporated entities to choose whether to be taxed as partnerships or as corporations.

Under the check the box entity classification regulations an organization that is recognized for federal tax purposes as an entity separate from its owners can potentially be classified as. The check the box regulations set forth rules for classifying business entities for federal tax purposes. These long awaited regulations which are effective january 1 1997 dramatically change the rules governing.

The check the boxregulations simplify entity classification by allowing a taxpayer to choose to be treated as a corporation or transparent entity for u s. The check the box classification regulations provide a default rule for an eligible entity that does not elect its classification.