Check The Box Election Meaning

27 the check the box election would cause a deemed liquidation of the target corporation for u s.

Check the box election meaning. The check the box classification regulations provide a default rule for an eligible entity that does not elect its classification. The check the box ctb regulations regs. 301 7701 1 through 301 7701 3 have provided taxpayers with ease and flexibility with regard to choice of entity.

In december 1996 the internal revenue service issued final regulations often referred to as the check the box regulations that allow unincorporated entities to choose whether to be taxed as partnerships or as corporations. One of the most fundamental decisions to make early on is how the foreign entity will be treated for u s. Specifically they expanded the opportunity for hybrid branch or hybrid entity strategies which take advantage of differences in the classification of an entity as a corporation or not in multiple jurisdictions in order to engage in cross border tax arbitrage.

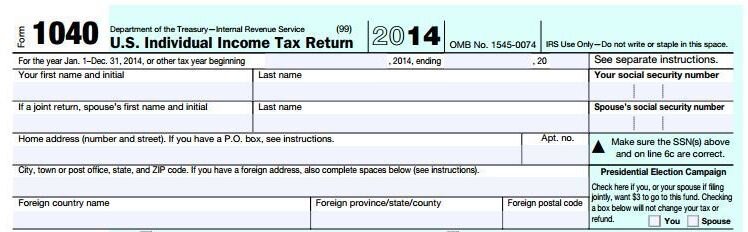

In short a check the box election is an entity classification election that is made on i r s. The check the box regulations potentially provide taxpayers flexibility in this regard by permitting the effective date of the election to be up to 75 days before the date on which the election is filed. The procedure to make a check the box election is quite easy.

Unless all information required by form 8832 including the entity s taxpayer identification number is provided. The most basic reason for making the check the box election is to ensure that the owner of the corporation in the us is properly credited with the foreign tax payments. You simply check the appropriate box specify the date that the election is to be effective sign and file the form.

The election must be signed by i each. This can pose a problem for entities that do business in multiple states because the states themselves differ as to whether they adopt the check the box rules. The federal entity classification check the box rules allow some entities to elect how they will be taxed for federal purposes.

A check the box election will avoid the attribution of income under cfc rules or the loss of long term capital gains tax rate discounts when shares are transferred in a passive foreign investment company pfic. The check the boxregulations simplify entity classification by allowing a taxpayer to choose to be treated as a corporation or transparent entity for u s. An election is necessary only when an eligible entity chooses to be classified initially other than under the default rule or when the entity chooses to change its classification.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/3VPYKXFO4BAQRK3TMHT64ECL7M.jpg)