Check The Box Election For Us Tax Purposes

Form 8832 entity classification election.

Check the box election for us tax purposes. A check the box election will avoid the attribution of income under cfc rules or the loss of long term capital gains tax rate discounts when shares are transferred in a passive. An election is permitted in this case the check the box election whereby the us llc may be designated to be a corporation for us tax purposes. You simply check the appropriate box specify the date that the election is to be effective sign and file the form.

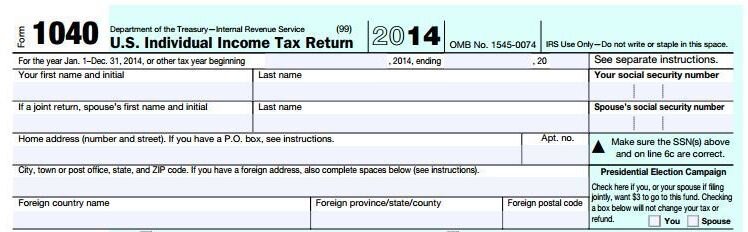

Trusts are not considered business entities see regs. The most basic reason for making the check the box election is to ensure that the owner of the corporation in the us is properly credited with the foreign tax payments. In short a check the box election is an entity classification election that is made on i r s.

1 an association taxed as a corporation 2 a partnership 3 a disregarded entity or 4 a trust. In such a circumstance where a check the box election is made does cra agree generally speaking that the making of the check the box election has no implications for canadian tax purposes.